Many of you know that I moved to Singapore last year.

This was a HUGE move for my family and I. It defintely has had its challenges, but all in, we have been delighted with the outcome.

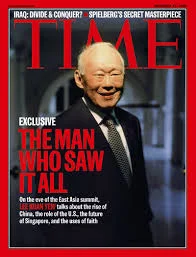

This week Lee Kuan Yew passed away. LKY was a true giant and statesman. Most Americans have no idea who he is/was, and it was only in Kissinger's eulogy in The Washington Post (click here to read it) that Americans might have begiun to understand the man.

Pragmatic. Unapologetic. Determined.

LKY dedicated his life to Singapore. What he accomplished in under 50 years is incredible.

When I look out my apartment view this is what I see:

Downtown CBD in Singapore

In just under 50 years LKY built this entire country into a first world nation. AAA credit rating (remember those?) and one of the safest cities in the world.

My children now take taxis anywhere. They ride the subways alone. Would I have ever done this in the USA?

Conversely, this week, it is easy to see the absurdity of the US political process again in Indiana. It continues to baffle me how the US continues to shoot itself in the foot.

But the focus this week was US rates. Chairwoman Yellen confirmed that rates would go higher. Albeit gradually.

What does this mean for the economy? What does this mean for housing?

One could argue that over the past several years we experienced nothing more than an asset appreciation due to low rates and a low dollar.

But with oil at these low levels (is it a market or policy phenomena from the Saudis?)

For your portfolio, this means one thing very very clearly: Start locking down rates. At PIMCO they would refre to this as "the handoff", when the yield curve would change again. The yield curve is beginning that now.

What is tricky is the issue of the dollar. A stronger dollar and higher rates do not bode well for the US economy, hence Yellen's slow approach.

But as you review your portfolio, think on several things:

- Is the US economy where you want to be now?

- Should you be allocating to countries who are still in a depreciating currency?

- Is a US-centric equity portfolio the correct one?

- Should you own long-dated bonds at all?

Use this as an opportunity to talk with one of our advisors. They are free and always available by clicking here.

As the US economy transitions, we also witness a transition here in Singapore. It is a sad day for the country, but they have shown an amazing resilience with regards to change.

I just hope the USA can do the same.