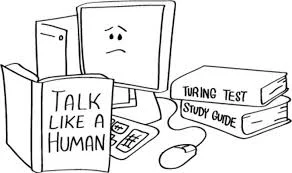

The classic Artificial Intelligence test was whether or not a human could discern if a concealed computer was human or not based on their responses to questions.

This was recently accomplished (click here).

For advisors, this test could also be constructed relative to a robo-advisor based on one simple question:

“Should the user/client invest or not?

What would the robo-“advisor” answer?

Invest.”

The robo-advisor wouldn’t preclude you from investing. It would not debate you.

In fact, the robo would ask you a series of questions beforehand to assess the extent of your investing experience (akin to a Vegas casino’s warnings about gambling).

“But what would a true HUMAN advisor do?”

They might tell you to not invest.

This presents an interesting dilemma.

“Is the robo-advisor truly a fiduciary?”

Or, is it an enabler? A very efficient enabler.

This is important to consider in light of the fight in Washington regarding the definition of a fiduciary (click here).

If we were to truly look at the robo-advisor community we might want to shift the paradigm.

“Are they robo-advisors, or robo-TAMPS?”

A critical eye might conclude the latter.